REAP Meeting Information

Next REAP Meeting

July 11, 2024

Quarterly REAP Meeting

If you would like to receive meeting notices, please send your email address to admin@i-70reap.com.

Regional Governments

- Adams County

- Arapahoe County

- City of Aurora

- Town of Bennett

- Town of Deer Trail

- State of Colorado

- Colorado Tourism

Chamber of Commerce

- Aurora Chamber of Commerce

- Denver Metro Chamber of Commerce

- Metro Denver Economic Development Corporation

- I-70 Corridor Chamber of Commerce

Airports

CHEMISTRY AND AGRICULTURE SHOW THE FUTURE TO AREA STUDENTS

Experts in science, manufacturing, business, education and government introduced career opportunities for 20 rural students during a learning excursion to CBD maker Kazmira on Wednesday April 24.

Coming from Strasburg and Byers High School, they saw how hemp becomes a product by a woman-owned business that combines chemistry and agriculture. They learned from start-up company Orenga about the climate-based options for regenerative agriculture technology, practices and the carbon-capturing product biochar.

And they got a sneak peek at blueprints for a production plant to make biochar and develop graphene, another carbon product with super strength capabilities high in global demand.

The excursion was organized by the Regional Economic Advancement Partnership, Kazmira Biotechnology, Orenga LLC, Morgan Community College, Byers and Strasburg Schools Districts.

CONTACT: Kip Cheroutes (REAP)

Lxc.strategies@gmail.com

303.204.0479

2023 Lowry Ranch Project - CIVITAS

2023 Town of Bennett Updates

2023 Overview of Arapahoe County Water Plan

2023 Adams County Master Plan

2022 CORE Changing Utilities, Challenges & Workforce Development

2022 Bennett Planning & Economic Development

2022 Colorado Electrification Transportation

2022 Colorado's Power Pathway

2022 Water - What's Available and how far can it go?

2022 Bustang Route Limon to Denver

2022 Arapahoe County Watkins/Bennett Area Vision Study

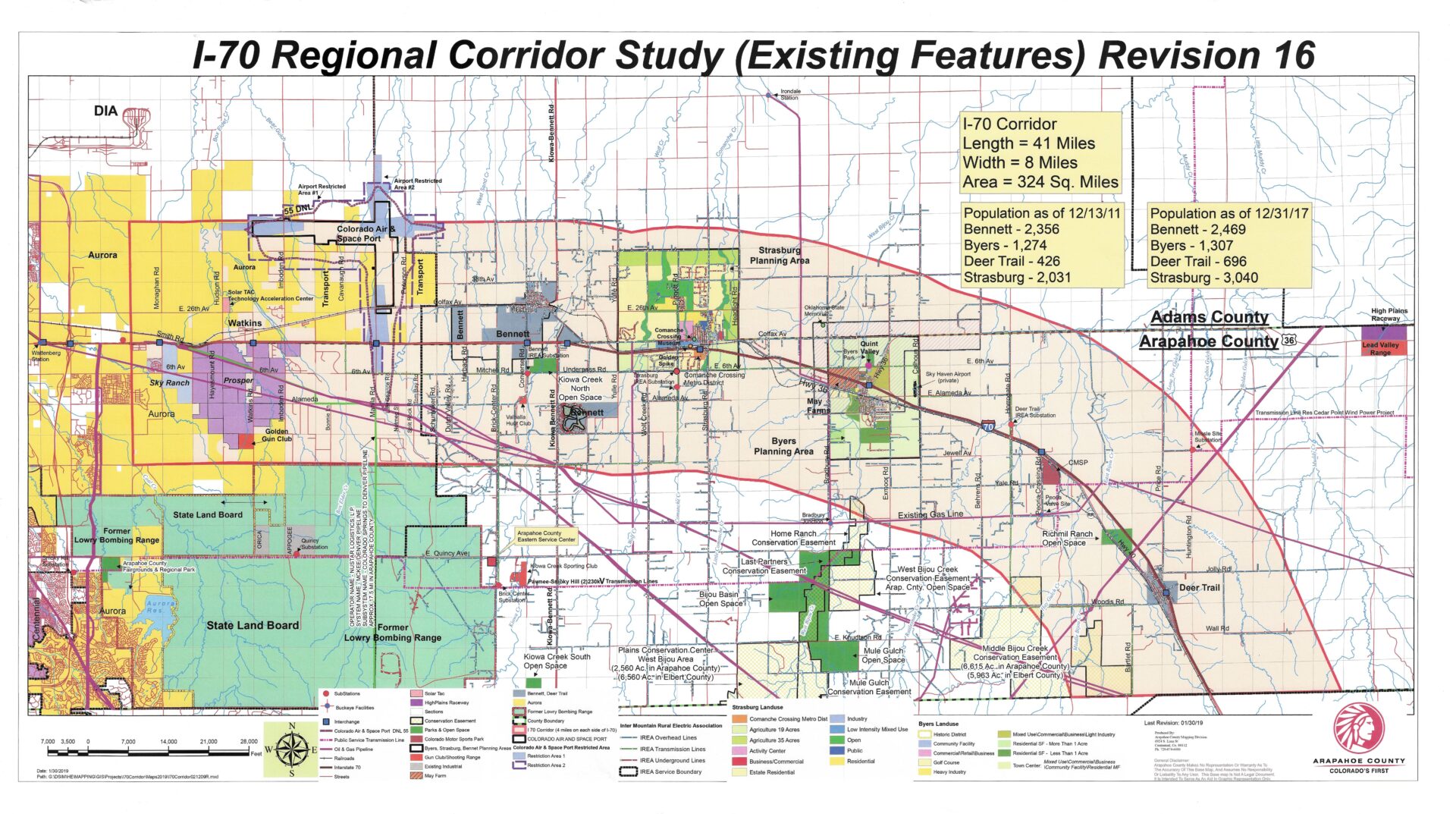

Maps

Take Note

ALERT: REAP-AREA BUSINESSES ELIGIBLE FOR STATE TAX CREDITS

Colorado gave final OK June 20, 2024 to a redrawing of the South Metro Enterprise Zone, which allows for nine state tax credits and exemptions. The new zone includes Byers, Deer Trail and Strasburg.

Enterprise zones (EZ) are meant to stimulate investment in lagging communities. And rural, distressed communities get enhanced tax breaks for hiring new employees.

Investment tax credit: 3% of an investment in business personal property.

Job Training tax credit: 12% of eligible job training costs for employees working within the zone.

New Employee tax credit: $1,100 per net new employee and extra credits as enhancement.

Employer sponsored health insurance tax credit: for the first two years a business is in

an EZ, $1,000 per net new employee insured under a qualified health plan in which the

employer pays at least 50% of the cost.

Research and development tax credit: 3% tax credit for an increase in annual R&D expenses compared

to the previous two years.

Vacant commercial building rehabilitation tax credit: for a building at least 20 years old and vacant for

at least two years, 25% of rehabilitation costs (up to $50,000 in credits on $200,000 or more on

costs).

Commercial vehicle investment tax credit: 1.5% of the price of new commercial trucks, truck trailers,

tractors, semi-trailers and associated parts registered in Colorado and used in the zone.

Sales and use tax exemptions for manufacturing and mining: expands the exemption to include non-

capitalized equipment and parts used in the zone.

Contribution tax credit: for individuals who contribute to community supported, state approved

enterprise zone projects, 25% of a cash donation, 12.5% of an in-kind donation capped at $100,000

to a local nonprofit organization or government entity that will manage the project.

Businesses must be certified by the state and county before being eligible for the tax credit. Arapahoe County will adopt policies and procedures soon. The expected start date is fall 2024.

REAP will play a key outreach and education role. Watch for updates here and at future public forums.